#Textron Systems

Explore tagged Tumblr posts

Text

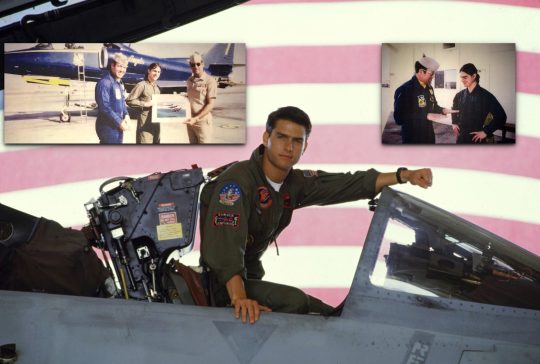

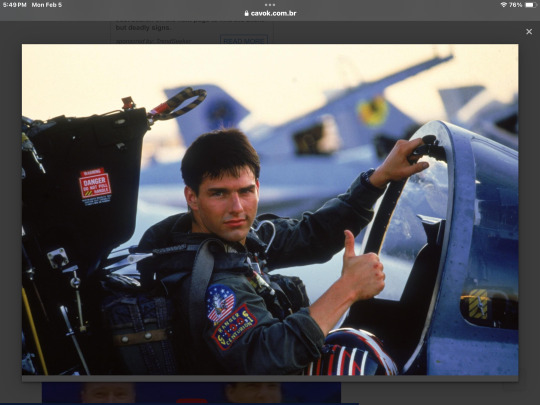

How the Blue Angels convinced Tom Cruise to make the movie "Top Gun"

Fernando Valduga By Fernando Valduga 05/02/2024 - 00:03in Demonstration Squads, History, Military

It's hard to imagine a world without the Top Gun movie. Aviation lovers watch at least once a year, despite the banality of the 80s, because the flight scenes are as cool now as they were more than 30 years ago. The best talents were hired to ensure a successful production, but the star of the film needed to be convinced by the Blue Angels to finally decide to become Maverick.

In another fantastic interview with Ryan Notthaft on Blue Angel Phantoms on YouTube, the Blue Angel pilot who piloted Tom Cruise, Curt "Griz" Watson, talks about his experience.

youtube

When reading the script alone, Cruise didn't find it funny. He was a serious actor who was still standing out, and there was a lot of apprehension about how the audience would receive an aviation film. Because the truth is that no aviation movie was really a big box office success before Top Gun.

But the producers knew they had a winner. They considered Top Gun as "Star Wars on Earth", inspired by a story years earlier in California Magazine. But Cruise initially did not share his vision, nor did many producers before Paramount. They had no real characters or stories, just cool jets.

"When I first read it, I thought they had a very limited story and script," Cruise recalled in an old behind-the-scenes article about the production of the film, which you can watch at this link. "I thought so, I don't know about it."

In a final desperate attempt to convince Cruise to join, producer Jerry Bruckheimer called Navy Admiral Peter Garrow, asking Cruise of the Navy to convince him to make the film. Garrow, of course, called the Blues Angels with the orders.

Grizz exceeded Cruise's expectations very well on the team's No. 7 jet, an A-4 Skyhawk. With a bag full of vomit, Cruise was hooked and his love affair with aviation began. When he landed he walked to the nearest public phone, called Bruckheimer and said "I do this".

But he was not satisfied only with the flight on the A-4 of the Blue Angels. After all, Mav is an F-14 Tomcat pilot. So Cruise requested flight time on the F-14 as part of his character's development. What made perfect sense. Cruise even put this in his contract. The producers and the Navy happily accommodated him.

youtube

His first F-14 flight also hit him in the head. Your pilot, indicative of call Bozo, put him in a difficult situation. You can watch the interview above about some of these flights, or better yet, watch the video here where Cruise and Bozo talk about it.

He loved piloting the F-14 so much that he even told his pilots "let's film these scenes and then tear everything apart. I'll evaluate you about who is the best driver." Each pilot wanted to know how his other pilots fared and then competed to see who could kick Tom's ass harder.

Cruise has been in love with flying since then. He is now a talented pilot, certified for various types of aircraft. He also owns a World War II P-51 Mustang fighter.

Source: AvGeekery

Tags: Blue AngelsDouglas A-4 SkyhawkHISTORYTop GunUSN - United States Navy/U.S. Navy

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

United States will send the aircraft carrier George Washington to the coast of Argentina

03/02/2024 - 20:04

HISTORY

Team of researchers may have found Amelia Earhart's plane

03/02/2024 - 12:48

MILITARY

UAS Aerosonde of Textron Systems performs operational flight from a Coastal Combat Ship

30/01/2024 - 14:00

HISTORY

14 years ago, I fled the first Su-57 (PAK FA)

29/01/2024 - 23:10

HISTORY

75 YEARS OF AIR DOMAIN: a chronological history of U.S. fighters

28/01/2024 - 21:45

MILITARY

IMAGES: U.S. Navy completes V-22 Osprey sea tests aboard HMS Prince of Wales

26/01/2024 - 09:00

19 notes

·

View notes

Text

Cazas F-16 de la Fuerza Aérea de Rumania en acción por primera vez en los cielos de España

Aviones de combate F-16 están operando estas semanas sobre los cielos de España, varios de la Fuerza Aérea de Turquía y, por primera vez, de la de Rumania están participando en el curso de élite de la OTAN TLP, que tiene sede en la base aérea del Ejército del Aire y del Espacio de Albacete. Tras el verano ha comenzado una nueva edición del curso de vuelo del programa de liderazgo táctico TLP (Tactical Leadership Program), el denominado FC (Flight Course) 2024-3 comenzaba el 16 de septiembre, y concluirá el viernes 4 de octubre, con una duración de 3 semanas. El TLP recibirá unas 650 personas, 34 de ellos se graduarán en este curso, todo un referente en el ámbito de la OTAN, serán 22 pilotos, 6 oficiales de inteligencia y 6 controladores aéreos. Los vuelos, que se realizan de lunes a viernes en periodo de tarde, dieron comienzo el 23 de septiembre, ya que la primera semana se dedica a la actividad académica y a vuelos en simulador. Las naciones participantes en el bando Blue aportarán 18 plataformas, serán España con aviones Eurofighter, Francia con sus aviones de combate Dassault Aviation Mirage 2000D y Mirage 2000-5, Estados Unidos con los espectaculares biplazas F-15E Strike Eagle, y Rumanía y Turquía con F-16. Destaca la presencia por primera vez en España de aviones de combate de la Fuerza Aérea de Rumania, que trasladó a Albacete tres de sus F-16AM MLU (Mid Life Update o Actualización de Media Vida). Esta fuerza aérea de la OTAN adquirió una docena de estos cazas a Portugal de segunda mano en la pasada década, a los que luego sumó otros 5 de la misma procedencia, estando ahora en proceso de recibir otros 32, tras darlos de baja la Real Fuerza Aérea de Noruega. En cuanto a la participación del bando oponente (Red Air), cuentan con un total de 6 aeronaves, siendo las naciones participantes: España con Eurofigher, F-18A y F-18M de sus Alas 11, 46 y 12 respectivamente; y Estados Unidos con los referidos F-15E, de los que en total han llegado a Albacete una docena desde su base de RAF (Royal Air Force)-Lakenheath (centro de Inglaterra), que forma parte de la Fuerza Aérea de los Estados Unidos en Europa o United States Air Force Europe (USAFE). Como apoyo a la realización del curso de vuelo se cuenta, como es ya habitual desde la implantación del TLP en España en 2008, con el concurso de medios de Mando y Control del Ejército del Aire y del Espacio español (EA) durante la ejecución de las misiones. Es de destacar también la participación del avión remotamente tripulado o RPAS (Remotely Piloted Aircraft Systems) MQ-9 Predator B (NR-05) del Ala 23, así como de dos instructores belgas especialistas en misiones de rescate de personal y equipos adicionales de control aéreo táctico americanos y españoles. Como amenaza antiaérea está prevista la participación de sistemas reales de defensa aérea del Ejército del Aire y del Espacio, misiles antiaéreos MBDA Mistral y el de simulación, que realiza la iluminación a las aeronaves con láser o radar Textron Mallina, del que ya hablamos en defensa.com Para simular amenazas también se cuenta con varios sistemas de simulación de la empresa americana Polygon, junto con el sistema del Armée de l´Air et de l´Espace francés ARPEGE que, como los medios españoles, estarán desplegados en distintas zonas del área de operación. Respecto a la intervención de otros medios aéreos, en el ámbito de la búsqueda y rescate en combate o Combat Search and Rescue (CSAR) de las tripulaciones abatidas se espera la participación en misiones específicas de un helicóptero NH 90 del Ejército del Aire y del Espacio en el bando Blue Air, junto con sus respectivos equipos de extracción, y de dos helicópteros Sikorsky MH-60R Seahawk de la Marina de los Estados Unidos en el bando Red. También se contará con la colaboración de un avión de transporte táctico C295 del Ala 35. Finalmente, desde las instalaciones del TLP se continuará utilizando el avanzado simulador de vuelo (MACE), que permite entrenar a los pilotos no solo en el entorno virtual, también interactuar con las aeronaves en misiones reales a través de avanzados protocolos de comunicación. Fuente: Read the full article

2 notes

·

View notes

Text

Stingray light tanks of the Royal Thai Army's 26th Cavalry Squadron, 3rd Cavalry Regiment during a combat readiness exercise in Mueang Phetchabun District, July, 2020.

The Stingray, also known as the Commando Stingray, is a light tank produced by the American Textron Marine & Land Systems, formerly Cadillac Gage. Instead of being aimed for the U.S. Military, Cadillac Gage intended for the Stingray to be an export vehicle. The first prototype was produced in 1985, and in 1987 the Stingray found its first — and only — user, Thailand, who announced their intention to purchase 106. All of these were delivered by the end of 1989, and Thailand still has a number in service as of 2023, though they have been supplemented by Chinese VT4 main battle tanks among other armored vehicles.

10 notes

·

View notes

Text

War Profiteers

Remember President Dwight “Ike” Eisenhower, who after green-lighting the overthrow of Iran’s democracy in 1953 at the behest of petrochemical corporations, had a change of heart and warned about the Military Industrial Complex? Here are the top 100 USA Military Industrial Complex “defense” contractors, all corporate welfare queens mooching off the public, who have blood on their hands in Palestine and elsewhere:

Academi

Action Target

ADT Corporation

Advanced Armament Corporation

AECOM

Aerospace Corporation

Aerovironment

AirScan

AM General

American Petroleum Institute

Argon ST

ARINC

Artis

Assett

Astronautics Corporation of America

Atec

Aurora Flight Sciences

Axon Enterprise

United Kingdom BAE Systems

BAE Systems Inc

Ball Corporation

Ball Aerospace & Technologies

Barrett Firearms Manufacturing

Battelle Memorial Institute

Bechtel

Berico Technologies

Boeing Defense, Space & Security

Booz Allen Hamilton

Boston Dynamics

Bravo Strategic

CACI

Carlyle Group

Carnegie Mellon University

Ceradyne

Cloudera

Colt Defense

The Columbia Group

Computer Sciences Corporation

Concurrent Technologies Corporation

CSRA (IT services company)

Cubic Corporation

Omega Training Group

Curtiss-Wright

DeciBel Research

Dillon Aero

Dine Development Corporation

Draper Laboratories

DRS Technologies

DynCorp

Edison Welding Institute

[Israei]l Elbit Systems

M7 Aerospace

Ensco

United Kingdom/Military contractor Ernst & Young

Evergreen International Aviation

Exxon

Fluor Corporation

Force Protection Inc

Foster-Miller

Foster Wheeler

Franklin Armoury

General Atomics

General Dynamics

Bath Iron Works

General Dynamics Electric Boat

Gulfstream

Vangent

General Electric Military Jet Engines Division

Halliburton Corporation

Health Net

Hewlett-Packard

Honeywell

Humana Inc.

Huntington Ingalls Industries

Hybricon Corporation

IBM

Insight Technology

Intelsat

International Resources Group

iRobot

ITT Exelis

Jacobs Engineering Group

JANUS Research Group

Johns Hopkins University

Kaman Aircraft

KBR

Kearfott Corporation

Knight's Armament Company

Kratos Defense & Security Solutions

L3Harris Technologies

Aerojet

Brashear

[France] Lafayette Praetorian Group

Lake Shore Systems

Leidos

EOTech

Lewis Machine & Tool Company

Lockheed Martin

Gyrocam Systems

Sikorsky

LRAD Corporation

ManTech International

Maxar Technologies

McQ

Microsoft

Mission Essential Personnel

Motorola

Natel Electronic Manufacturing Services

Navistar Defense

Nextel

Northrop Grumman

Northrop Grumman Electronic Systems

Northrop Grumman Ship Systems

Northrop Grumman Technical Services

Northrop Grumman Innovation Systems

NOVA

Oceaneering International

Olin Corporation; also see John M. Olin and John M. Olin Foundation

Oshkosh Corporation

Para-Ordnance

Perot Systems

Picatinny Arsenal

Pinnacle Armor

Precision Castparts Corporation

Raytheon Technologies

Collins Aerospace

Rockwell Collins

Goodrich Corporation

Pratt & Whitney

Raytheon Intelligence & Space

Raytheon Missiles & Defense

Raytheon BBN

Remington Arms

Rock Island Arsenal

Roundhill Group

Ruger

Saab Sensis

Science Applications International Corporation (SAIC)

SGIS

Sierra Nevada Corporation

Smith & Wesson

Smith Enterprise (SEI)

SPRATA

Springfield Armory

SRC Inc

SRI International

Stanley

Stewart & Stevenson

Swift Engineering

Tactical Air Support

Teledyne

Teledyne FLIR

Textron

AAI Corporation

Bell Helicopter Textron

Trijicon

TriWest Healthcare Alliance

Unisys

U.S. Ordnance

Verizon Communications

Vinnell Corporation

Westinghouse Electric Corporation

8 notes

·

View notes

Photo

(via XM1 Abrams Main Battle Tank by DarkWizard83 on DeviantArt)

The original prototype vehicle that led to one of - if not the - most powerful tank in the world, and current backbone of Us armored forces, the M1 Abrams MBT. Born out of the failed German-American MBT-70 project, the XM1 was developed by the Chrysler Motor Corporation, and in 1978 Chrysler delivered to the Army a sleek, low-silhouette heavy tank that incorporated every major technological feature of the day, including computerized controls and a laser rangefinder. But the most significant design feature of the new tank was its use of Chobham composite armor on the hull and turret. While the exact nature and composition of Chobham armor remains a closely guarded secret, the evidence suggests that it utilizes a matrix of ceramic armor tiles, layered between the vehicle's internal steel and external armored plating. When a high-velocity projectile - such as a round fired from a tank or an anti-tank missile - hits the armor, the explosion produces a high-velocity jet of gas that shears through the armor plating. In normal armor, this jet of gas - once it had passed through the outer armor - would blast into the hull of the tank, causing irreprible damage and often killing the crewmen inside. However, with Chobham armor's interweaved layers of ceramic composite, the forces that would normally tear into a tank's hull are forced to spread out and dissipate over a much wider area, leaving the inner hull intact. This not to say that Chobham armor renders a tank invincible - any hit will still cause exterior damage, and a powerfiul direct hit could still damage or disable the tracks or sensitive electronic equipment. But it would keep the crew alive, and often protect the tank itself enough to keep fighting. Another key crew safety feature is the vault-like armored compartment that houses the Abrams' primary ammunition. One of the primary causes of a tank's destruction has not been the direct result of armor-pierecing hits, but the inderict results of those hits ignigting and detonating the tank's munitions. To protect this, a kevlar and steel armored plate seperates the crew from the ammunition store. Same with the tank's fuel supply. Even if the compartments were pierced, and the ammunition or fuel ignited, the protective plates would insulate the crew from explosion and fire. In combat, the Abrams has proven to be second to none. During Operation Desert Storm in 1991, M1s were able to take out Iraqi tanks at distances as long as 4km. Of the nearly 2,000 Abrams to see combat in the conflict, only 18 were ever taken out of service due to combat damage, and none resulted in any crew casulties. In 2003 and onwards during Operation Iraqi Freedom, the Abrams again demonstrated a mastery of the battlefield, driving to Baghdad virtually unopposed. However, the Abrams clearly showed its vulnerability to ambush attacks, with a number of M1s severly damaged and disabled from RPGs, and far more frequently by roadside IED bomb traps. However, even when caught in some of the largest IED explosions, crew casualties have so far been astoundingly low, a testament to the M1s protection and survivability. While no future M1's are planned for production, a number of older models are currently slated for upgrade to current standards over the next few years, and the Abrams will continue to serve with the Us Army and Marine Corps. for mcuh of the century to come. M1 Abrams Vehicle Stats: Type: Main battle tank Manufacturer: General Dynamics Land Systems First deployed: 1980 Crew: 4 Length: 9.76 m Width: 3.65 m Height: 2.88 m Weight: 61.4 tons Armor: Classified Armament, primary: 1 x 105mm M68 rifled tank gun; later models equipped with 120mm M256 smoothbore tank gun Armament, secondary: 2 x 7.62mm FN-Browning M240 machineguns, 1 x .50-cal Browning M2 BMG machinegun Ammo stowage, primary: 55 rounds Ammo stowage, secondary: 11,000 rounds 7.62mm, 1,000 rounds .50-cal Powerplant: Textron Lycoming AGT1500 1,500hp gas-turbine engine Max speed: 72 km/h Max range: 498km Operators: Australia, Egypt, Kuwait, Saudi Arabia, USA

14 notes

·

View notes

Text

You're not wrong, but counterpoint: slotted is such utter garbage. Phillips is better, but can strip (cam out) easily.

Six-lobe here (aka "star" or "Torx™" or per ISO 10664 "hexalobular internal") is the superior screw drive system. It was developed in 1967 by the industrial conglomerate Camcar Textron. It more evenly distributes the force across six lobes than the four lobes on Phillips, meaning it's less likely to cam out, but because the plane of contact where force is applied is closer to 90° than a conventional hex drive it's able to generate more torque.

23K notes

·

View notes

Text

Europe General Aviation Market Size, Revenue, End Users And Forecast Till 2028

The Europe general aviation market is expected to reach US$ 6,377.92 million by 2028 from US$ 4,473.58 million in 2021; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028.

Factors such as increasing demand for charter aviation and surging demand for electric aircraft across Europe propel the growth of the market. However, predicted onset of the third wave of COVID-19 outbreak by research organizations across the world may hamper the market growth.

The global aviation industry accounts for ~2.5% of the global carbon emissions, causing environmental pollution, and it is one of the major concerns across the aviation sector. Several vendors and aviation research organizations have been working on the development of advanced power-efficient and low-emission aircraft models, such as hybrid electric and fully electric aircraft. Electric aircraft systems are powered by one or more electric motors that drive the propellers. Electricity may be supplied by a variety of methods, the most common being batteries. In 2021, Rolls-Royce announced the completion of its maiden flight for an intense flight-testing phase of its fully electric aircraft.

Grab PDF To Know More @ https://www.businessmarketinsights.com/sample/BMIRE00029439

The List of Companies - Europe General Aviation Market

Airbus

Boeing

Leonardo S.p.A.

Saab AB

Dassault Aviation

PILATUS AIRCRAFT LTD

Textron Inc.

Bombardier

Gulfstream Aerospace Corporation

Embraer

Business Market Insights performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defence; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

0 notes

Video

Tiltrotor Research Aircraft Hovering by NASA on The Commons Via Flickr: This photo shows the unique XV-15 Tiltrotor aircraft in vertical flight at the NASA Dryden Flight Research Center. The XV-15s, manufactured by Bell, were involved in limited research at NASA/Dryden in 1980 and 1981. The development of the XV-15 Tiltrotor research aircraft was initiated in 1973 with joint Army/NASA funding as a "proof of concept", or "technology demonstrator" program, with two aircraft being built by Bell Helicopter Textron (BHT) in 1977. The aircraft are powered by twin Lycoming T-53 turboshaft engines that are connected by a cross-shaft and drive three-bladed, 25 ft diameter metal rotors (the size extensively tested in a wind tunnel). The engines and main transmissions are located in wingtip nacelles to minimize the operational loads on the cross-shaft system and, with the rotors, tilt as a single unit. For takeoff, the proprotors and their engines are used in the straight-up position where the thrust is directed downward. The XV-15 then climbs vertically into the air like a helicopter. In this VTOL mode, the vehicle can lift off and hover for approximately one hour. Once off the ground, the XV-15 has the ability to fly in one of two different modes. It can fly as a helicopter, in the partially converted airplane mode. The XV-15 can also then convert from the helicopter mode to the airplane mode. This is accomplished by continuous rotation of the proprotors from the helicopter rotor position to the conventional airplane propeller position. During the ten to fifteen second conversion period, the aircraft speed increases and lift is transferred from the rotors to the wing. To land, the proprotors are rotated up to the helicopter rotor position and flown as a helicopter to a vertical landing. NASA Media Usage Guidelines Credit: NASA Photo number: EC80-13848 Date: 1980

1 note

·

View note

Text

Europe Military Drones Market Key Companies Profile, Supply, Demand and SWOT Analysis (2023-2028)

The Europe military drones market is expected to grow from US$ 3,834.49 million in 2023 to US$ 5,931.60 million by 2028. It is estimated to grow at a CAGR of 9.1% from 2023 to 2028.

Surge in Global Defense Sector Fuels Europe Military Drones Market

The ongoing transformation in modern warfare systems is urging governments regionally to increase financial allocations for their respective military forces. This increased budgetary capacity empowers military forces to acquire state-of-the-art technologies and equipment from both domestic and international suppliers. Simultaneously, soldier and military vehicle modernization initiatives are gaining traction in numerous countries. Given the escalating need to bolster military capabilities with advanced technologies, armaments, and vehicles, defense forces globally are investing substantial amounts. The continuous drive to integrate novel technologies into both offensive and defensive operations by defense forces is further boosting defense spending.

Asymmetric warfare or today's battlefields demand enormous information to execute operations successfully. Fiscal budgets are now heavily focused on robotic platforms and related technologies, contributing significantly to the development and procurement of military drones.

Download our Sample PDF Report

@ https://www.businessmarketinsights.com/sample/BMIRE00028705

Europe Military Drones Market Overview

By country, the Europe military drones market is segmented into France, Germany, Italy, the UK, Russia, and the Rest of Europe. Government authorities in Europe are rolling out new regulations for military drones. According to a news article by the European Commission in January 2023, new European Union (EU) rules focusing on establishing a dedicated airspace for drones—U-space—were enforced, allowing operators to provide a broader range of services. This U-space creates a safe operating environment for drones and facilitates the scaling up of the drone industry. These rules will contribute to improved military drones' performance in carrying out complex, long-distance operations. They also prioritize the technological development of drones under Drone Strategy 2.0 and support the full implementation of U-space by 2030. Furthermore, in May 2022, the Indian government conducted Bharat Drone Mahotsav 2022 to promote the use of drone technologies in defense. Such government initiatives are pivotal for the adoption and technological evolution of military drones, driving market growth.

Europe Military Drones Market Segmentation

Europe Military Drones Market By Type

Group 1

Group 2

Group 3

Group 4

Group 5

Europe Military Drones Market By Application

ISR

Warfare

Europe Military Drones Market By Range

Short Range

Medium Range

Long Range

Europe Military Drones Market By Technology

Fixed Wing

Rotary Wing

Europe Military Drones Market Regions and Countries Covered

Europe

UK

Germany

France

Russia

Italy

Rest of Europe

Europe Military Drones Market leaders and key company profiles

AeroVironment Inc

BAE Systems Plc

Elbit Systems Ltd

General Atomics

Lockheed Martin Corp

Northrop Grumman Corp

Textron Systems Corp

Thales SA

The Boeing Co

Israel Aerospace Industries Ltd

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

0 notes

Text

North America Radar Simulator Market Analytical Overview, Comprehensive Analysis, Segmentation, Competitive Landscape and Industry Poised for Rapid Growth 2028

North America Radar Simulator Market Market Research Report 2022-2030 published by Business market insights shares a versatile overview of the market scenario including the present as well as the future state of the market. The report delivers content on emerging trends, and market dynamics with respect to drivers, opportunities, and challenges. The report throws light on the assessment of previous growth developments. It highlights market overview, key players profiling, key developments, suppliers of raw materials, and dealers, among other information. It also consists of market size, sales, Forecast, share, industry demand, growth rate, and revenue. The report also comprises the research and development activities of these companies and provided complete data about their existing products and services. Detailed analysis of revenue generation scope and probabilities, manufacturer profile, production details, consumption patterns have been given.

To get sample Copy of the report, along with the TOC, Statistics, and Tables please visit @ https://www.businessmarketinsights.com/sample/BMIRE00025786

The research report provides deep insights into the market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of North America Radar Simulator Market market during the forecast period, i.e., 2022–2030. Most importantly, the report further identifies the qualitative impact of various market factors on market segments and geographies. The research segments the market on the basis of product type, application, technology, and region. To offer more clarity regarding the industry, the report takes a closer look at the current status of various factors including but not limited to supply chain management, niche markets, distribution channel, trade, supply, and demand and production capability across different countries.

Major key players covered in this North America Radar Simulator Market Market report:

Adacel Technologies Limited

ARI Simulation

Buffalo Computer Graphics

Collins Aerospace

L3Harris Technologies, Inc.

Mercury Systems Inc.

Textron Systems Corporation

Ultra Electronics Inc.

The research provides answers to the following key questions:

What is the estimated growth rate of the market for the forecast period 2022–2030? What will be the market size during the estimated period?

What are the key driving forces responsible for shaping the fate of the North America Radar Simulator Market market during the forecast period?

Who are the major market vendors and what are the winning strategies that have helped them occupy a strong foothold in the North America Radar Simulator Market market?

What are the prominent market trends influencing the development of the North America Radar Simulator Market market across different regions?

What are the major threats and challenges likely to act as a barrier in the growth of the North America Radar Simulator Market market?

What are the major opportunities the market leaders can rely on to gain success and profitability?

The study conducts SWOT analysis to evaluate strengths and weaknesses of the key players in the North America Radar Simulator Market market. Further, the report conducts an intricate examination of drivers and restraints operating in the market. The report also evaluates the trends observed in the parent market, along with the macro-economic indicators, prevailing factors, and market appeal according to different segments. The report also predicts the influence of different industry aspects on the North America Radar Simulator Market market segments and regions.

Our reports will help clients solve the following issues: –

Insecurity about the future:

Our research and insights help our clients anticipate upcoming revenue compartments and growth ranges. This will help our clients invest or divest their assets.

Understanding market opinions:

It is extremely vital to have an impartial understanding of market opinions for a strategy. Our insights provide a keen view on the market sentiment. We keep this reconnaissance by engaging with Key Opinion Leaders of a value chain of each industry we track.

Interested in purchasing this Report? Click here @ https://www.businessmarketinsights.com/buy/single/BMIRE00025786

Understanding the most reliable investment centers:

Our research ranks investment centers of market by considering their future demands, returns, and profit margins. Our clients can focus on most prominent investment centers by procuring our market research.

Evaluating potential business partners:

Our research and insights help our clients identify compatible business partners.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

Contact Us:

If you have any queries about this report or if you would like further information, please

Contact Person: Ankit Mathur

Phone: +442081254005

E-Mail ID: [email protected]

Web URL: https://www.businessmarketinsights.com/

0 notes

Text

https://www.businesswire.com/news/home/20250313747768/en/Non-Lethal-Weapons-Global-Market-Forecast-Report-and-Competitive-Analysis-2025-2033-Featuring-Byrna-Technologies-General-Dynamics-Moog-Raytheon-Rheinmetall-Textron-Combined-Systems---ResearchAndMarkets.com

0 notes

Text

Lockheed Martin delivers 75º APY-9 radar for the E-2D Advanced Hawkeye built by Northrop Grumman

Setting the standard in the development and delivery of Airborne Early Warning (AEW) radars.

Fernando Valduga By Fernando Valduga 01/30/2024 - 16:00 in Military

Lockheed Martin, under contract with Northrop Grumman for the U.S. Navy's E-2D Advanced Hawkeye, delivered the 75º APY-9 radar that provides the U.S. Navy with information mastery through revolutionary sensor capability. More Hawkeyes were built and delivered than any other AEW platform in the world.

“As the primary sensor of the E-2D, the APY-9 radar has a long legacy of providing agile deterrence for greater security of the 21st century,” said Chandra Marshall, vice president of radar systems and sensors business at Lockheed Martin. “Our main focus is to bring our military and women home safely, and the APY-9 sets this standard for all other AEW radars.”

The newest Advanced Hawkeye variant is at the forefront of technological capacity, largely due to Lockheed Martin's APY-9 radar. The E-2 built by Northrop Grumman has become known as the "fleet eyes" of the U.S. Navy due to its ability to simultaneously monitor the air, land and sea. Whenever a Navy aircraft carrier has aircraft in the air, there is an APY-9 radar in operation, protecting the United States and its allies.

The U.S. Navy financed 80 of the 86 aircraft of the current purchase program. Japan bought 18 E-2D Hawkeyes and France bought three. With U.S. and international demand, APY-9 is expected to be in production by the end of the 2020s, and in modernization and support by the 2040s.

Lockheed Martin is a contributor to the E-2D built by Northrop Grumman for more than two decades. The E-2D Advanced Hawkeye platform provides critical and actionable data to enable decision mastery for joint forces and rescuers. These advances provide the armed forces with the necessary situational awareness to reduce the time between initial consciousness and active involvement.

Tags: Military AviationE-2D Advanced HawkeyeLockheed MartinNorthrop Grumman

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

UAS Aerosonde of Textron Systems performs operational flight from a Coastal Combat Ship

30/01/2024 - 14:00

Aurora's Liberty Lifter X-plane advanced in the preliminary tests.

MILITARY

Aurora modifies the design of the large Liberty Lifter aircraft

30/01/2024 - 09:00

MILITARY

Argentina decides to buy 24 American F-16 fighters instead of Chinese JF-17 jets

30/01/2024 - 06:00

BRAZILIAN AIR FORCE

VIDEO: See moment that FAB Super Tucano intercepts aircraft in Air Defense Identification Zone (ZIDA)

01/29/2024 - 23:48

HISTORY

14 years ago, I fled the first Su-57 (PAK FA)

29/01/2024 - 23:10

MILITARY

Czech Republic officially joins the global F-35 Lightning II team

29/01/2024 - 19:37

14 notes

·

View notes

Text

Powersports Market Size, Analyzing Trends and Projected Outlook for 2025-2032

Fortune Business Insights released the Global Powersports Market Trends Study, a comprehensive analysis of the market that spans more than 150+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

The Powersports Market is experiencing robust growth driven by the expanding globally. The Powersports Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Powersports Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Powersports Market is projected to grow from USD 8.76 billion in 2020 to USD 12.75 billion in 2027 at a CAGR of 5.5% in the 2020-2027 period. The rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/105156

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Major Powersports Market Manufacturers covered in the market report include:

Polaris Inc. (Minnesota, U.S.)

Textron Inc. (Rhode Island, U.S.)

Arctic Cat Inc. (Minnesota, U.S.)

Honda Motor Co., Ltd. (Tokyo, Japan)

BRP (Quebec, Canada)

Harley Davidson (Wisconsin, U.S.)

Kawasaki Heavy Industries, Ltd. (Tokyo, Japan)

KYMCO (Kaohsiung City, Taiwan)

Suzuki Motor Corporation (Shizuoka, Japan)

Yamaha Motor Co., Ltd. (Shizuoka, Japan)

Snowmobile tourism is actively promoted via trail maps, information guides, and state and provincial travel bureaus as it has become an important active outdoor recreation economic engine. For instance, according to the International Snowmobile Manufacturers Association, around USD 36 billion is spent on snowmobiling in the US and Canada each year.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

North America (United States, Mexico & Canada)

South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Powersports Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Powersports Market?

► Who are the prominent players in the Global Powersports Market?

► What is the consumer perspective in the Global Powersports Market?

► What are the key demand-side and supply-side trends in the Global Powersports Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Powersports Market?

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

Political (Political policy and stability as well as trade, fiscal, and taxation policies)

Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

Technological (Changes in digital or mobile technology, automation, research, and development)

Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Points Covered in Table of Content of Global Powersports Market:

Chapter 01 - Powersports Market for Automotive Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Powersports Market - Pricing Analysis

Chapter 05 - Global Powersports Market Background or History

Chapter 06 - Global Powersports Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Powersports Market.

Chapter 08 - Global Powersports Market Structure & worth Analysis

Chapter 09 - Global Powersports Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Powersports Market Research Methodology

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

Part 3 - Fun Fact for Gal Gadot (@gal_gadot):

Question:

Which countries have their own aircraft manufacturing companies, and what are the names of those companies?

ChatGPT Answer:

As of 2025, more than a dozen countries have domestic aircraft manufacturers that produce military and/or commercial aircraft. Some are global giants like Boeing and Airbus, while others focus on regional jets, military aircraft, or niche designs.

Here’s a list of notable countries with their own aircraft manufacturing companies, along with the factory/company names:

🇺🇸 United States

Boeing – Commercial and military aircraft

Lockheed Martin – Military (e.g. F-35)

Northrop Grumman – Military (e.g. B-2, B-21)

General Atomics – Drones (e.g. MQ-9 Reaper)

Gulfstream Aerospace – Business jets

Textron Aviation – Cessna and Beechcraft (private, trainer)

🇫🇷 France

Airbus – (HQ in France; multinational European company)

Dassault Aviation – Military and business jets (e.g. Rafale, Falcon)

🇩🇪 Germany

Airbus – Shares production and HQ with France and Spain

Grob Aircraft – Light aircraft

🇪🇸 Spain

Airbus Spain – Military transport (e.g. A400M)

CASA – Now part of Airbus Defence and Space

🇬🇧 United Kingdom

BAE Systems – Military aircraft (e.g. Typhoon, Tempest program)

Rolls-Royce – Aircraft engines (not full aircraft)

🇷🇺 Russia

Sukhoi – Military jets (e.g. Su-57)

Mikoyan (MiG) – Military jets

Tupolev – Strategic bombers

Ilyushin – Transport aircraft

Irkut Corporation – Commercial (e.g. MC-21)

Yakovlev – Light and trainer aircraft

(Most are now consolidated under United Aircraft Corporation)

🇨🇳 China

COMAC – Commercial (e.g. C919, ARJ21)

AVIC – Military and transport aircraft (umbrella for many sub-firms)

Chengdu Aircraft Corporation – Fighter jets (e.g. J-20)

Shenyang Aircraft Corporation – Military

🇯🇵 Japan

Mitsubishi Aircraft Corporation – (SpaceJet program, paused)

Kawasaki Heavy Industries – Military and cargo aircraft

ShinMaywa – Amphibious aircraft

🇮🇳 India

Hindustan Aeronautics Limited (HAL) – Fighters (e.g. Tejas), trainers, helicopters

🇧🇷 Brazil

Embraer – Regional jets, military transport, business jets

🇨🇦 Canada

Bombardier – Business jets (sold regional jet line to Airbus)

De Havilland Canada – Utility and regional aircraft

🇮🇹 Italy

Leonardo S.p.A. – Military and training aircraft (e.g. M-346)

🇸🇪 Sweden

Saab – Fighter jets (e.g. JAS 39 Gripen)

🇰🇷 South Korea

KAI (Korea Aerospace Industries) – Military jets (e.g. KF-21), trainers

🇹🇷 Turkey

TAI (Turkish Aerospace Industries) – Military drones, jets (e.g. Hürjet, Kaan)

🇵🇰 Pakistan

PAC (Pakistan Aeronautical Complex) – JF-17 (co-produced with China)

🇮🇩 Indonesia

PT Dirgantara Indonesia – Transport aircraft and helicopters

🇿🇦 South Africa

Denel Aeronautics – Trainers and drones

Would you like this list sorted by continent, aircraft type (civil vs. military), or company size?

0 notes

Text

McCauley Propeller obtuvo la certificación de la ANAC para su hélice de alto rendimiento diseñada para la serie Beechcraft King Air B300

McCauley Propeller Systems anunció hoy que su nueva hélice C780, diseñada para la serie Beechcraft King Air B300, obtuvo con éxito la certificación de la Agencia Nacional de Aviación Civil (ANAC) de Brasil. Este modelo consta de cuatro palas en flecha de aluminio y un diámetro de 105 pulgadas. Brasil alberga una base de turbohélices Beechcraft King Air, considerada la segunda instalación más grande a nivel mundial.

McCauley Propeller Systems es una división de Textron Aviation Inc., una empresa de Textron Inc.

"La hélice de alto rendimiento McCauley C780, con su diseño ligero de palas tipo cimitarra, mejorará la experiencia de vuelo de más de 700 King Air en Brasil", declaró Jason Hull, vicepresidente y director general de McCauley Propeller Systems. “Esta hélice ofrece versatilidad y mejoras en el rendimiento, para equipar a los clientes de la región con soluciones inteligentes que se adapten a misiones y circunstancias únicas”.

Con la nueva hélice C780, los propietarios y operadores de King Air B300 obtendrán las siguientes ventajas:

50 libras menos de peso de la hélice, en comparación con las opciones anteriores

Mayor rendimiento en despegues y ascensos

Reducción del ruido en la cabina y el puesto de pilotaje

Ampliación en el tiempo entre revisiones (TBO) de 5000 horas o 72 meses

Garantía limitada de hélices de Textron Aviation de 5000 horas o 36 meses

Los clientes de King Air B300 pueden instalar la hélice en su aeronave en un centro de servicio de Textron Aviation o en un centro McCauley de servicio autorizado sin necesidad de modificaciones adicionales.

Para obtener más información, visite mccauley.txtav.com/featured-products.

0 notes

Text

Future Outlook of the UAV Payload Market: Analyzing Size, Share, Growth Patterns

The global UAV payload market size is expected to reach USD 6.34 billion by 2022 according to a new report by Grand View Research, Inc. Technological advancements and increasing investments in R&D have driven the UAV market. Increasing demand in military and commercial UAV industry has propelled industry growth.

Payloads are a part of larger drone system and depend on the application segment of the UAV system. UAV payload comprises sensors, cameras, gimbal controllers, communications systems, and weaponry. Applications of such UAVs in energy, agriculture, retail, and media and entertainment sectors along with firefighting and surveying are expected to positively impact payload industry growth.

Drones are gradually becoming popular in the commercial sector as well after making their presence felt in the military sector. However, stringent government policies regulating the use of such UAVs commercially are expected to pose a challenge to the payload industry.

To request a sample copy or view summary of this report, click the link below: http://www.grandviewresearch.com/industry-analysis/uav-payload-market

Further key findings from the report suggest:

Camera, imagers, and sensing equipment segment led the global UAV payload industry accounting for nearly 40% of the industry revenue share in 2014. Increasing applications in law enforcement and surveillance activities are expected to drive the demand for such equipment over the next seven years. Moreover, use of drones with high resolution cameras in commercial film industry and aerial photography activities is expected to generate considerable demand for such equipment.

Radar and communication equipment form an essential part of military and commercial UAS. These form a link between the drone operator at the ground control unit and the UAVs enabling efficient navigation and maneuvering. Weaponry payload equipment is projected to grow at a CAGR of over 5% owing to the increasing adoption and deployment of drones in military and defense activities across the globe. Other payload equipment such as agricultural equipment, delivery drone equipment, and panels for solar-powered drone are anticipated to witness steady growth over the next few years.

North America dominated the global UAV equipment industry acquiring over 40% of the overall global revenue share in 2014. Extensive use of advanced military drones in combat operations and war zones is expected to drive growth in the region. Favorable initiatives by the government and aviation regulatory authorities such as the FAA in the U.S. and EASA in the European region regarding the use of commercial drones have led to an overall surge in demand for drone payload in the region.

Projected to grow at a CAGR of 5.6% from 2015 to 2022, Asia Pacific regional market is anticipated to be a region with vast growth avenues in the industry. Increased investments by countries such as China, India, and Japan in military and commercial drones are expected to derive huge demand for drones and its payloads over the forecast period.

Key drone payload manufacturers include Israel Aerospace Industries, L-3 Communications, Insitu, Orbit, and Textron Inc. Vendors are increasingly adopting mergers and acquisitions to establish dominance in the market. Drone manufacturers collaborate with technology suppliers to enhance their products as compared to their competitors’ products in the industry.

#UAVPayload#DronePayload#UAVMarket#DroneTechnology#AerialIntelligence#DroneIndustry#UAVSystems#DroneInnovation#TechTrends#AerospaceTech#NextGenDrone

0 notes